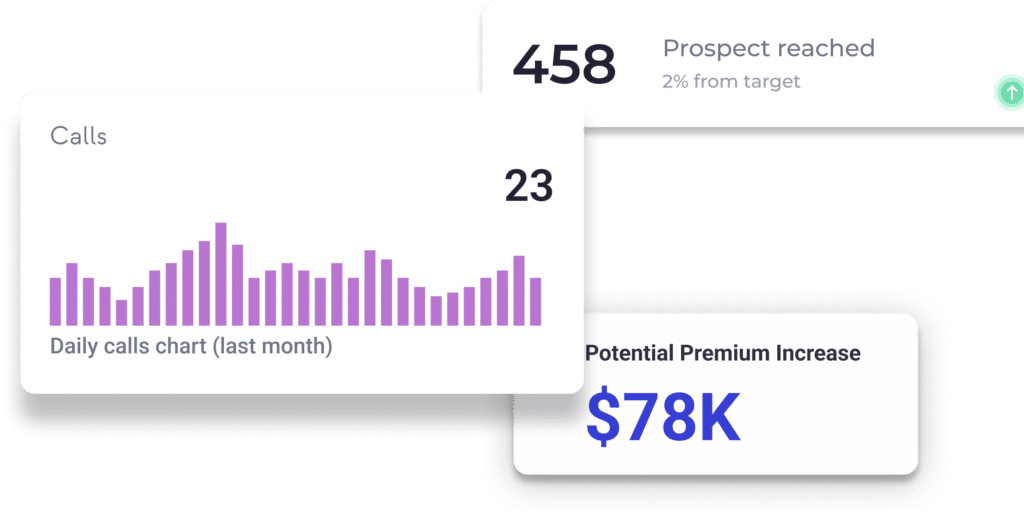

Reduce Volatility, Monetize Data, Increase Profitability

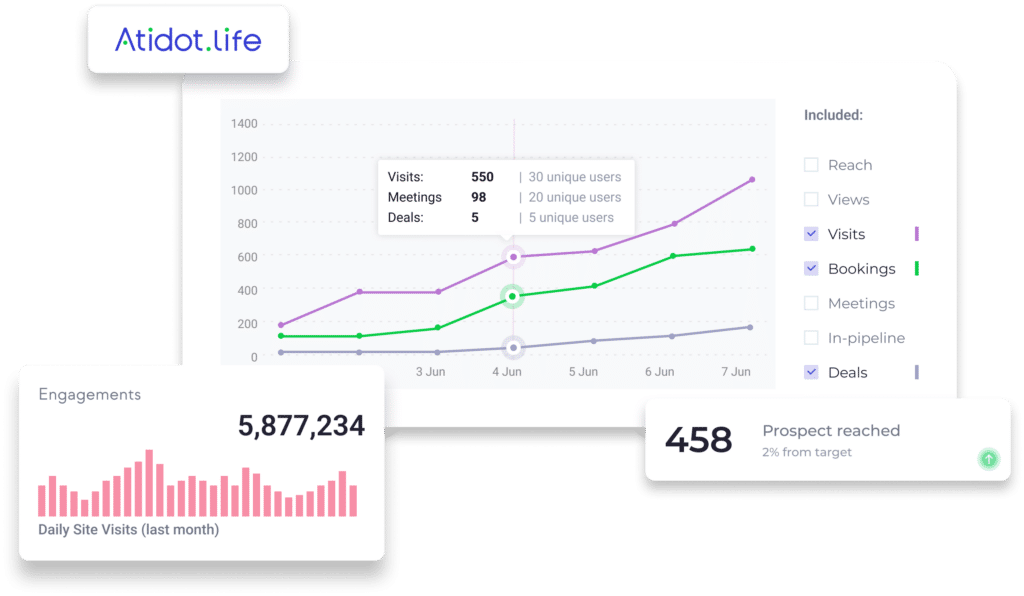

Data is a life insurer's greatest asset. Atidot's Al & machine learning solutions give you the tools to monetize data like never before, providing real-time actionable insights into customer behavior. Why compromise on efficiency? Atidot's insights help you make smarter business decisions at just the right time with just one click.